Please be sure to enter your Member ID WITHOUT

the NSA prefix—only the numbers, no letters.

Please be sure to enter your Member ID WITHOUT

the NSA prefix—only the numbers, no letters.

The date that is used to determine which timeframe earnings are attributed to will vary based on both the type of work and whether you are over 65 and have begun your pension.

For pensioners 65 and over, earnings will be attributed to the day they get processed by the Plans. This is to ensure that any earnings received late will not impact your current status with us or Medicare and will be counted towards the next cycle.

For all others, applied date will be the pay date as shown on your paychecks from employers for earnings with a SAG-Producers Pension component and the performance or earned date for earnings with an AFTRA Retirement component. In both cases, we depend on the information provided to us by employers. There may be some slight variability in the dates; we often see dates that reflect the end of a month or pay cycle. In almost every instance, this will have no impact on your benefit accruals. However, you should contact the Plans if you find that an earning has crossed the boundaries of a Pension year or your Base Earnings Period.

Earnings Reporting Timeline |

|

|---|---|

| Category | Earnings Application Date |

|

Retirees 65 and over |

Process Date |

|

Contributions with a SAG-Producers Pension Plan Component |

Pay date (paycheck date) |

|

Contributions with an AFTRA Retirement Fund Component |

Performance/Earned date (job date) |

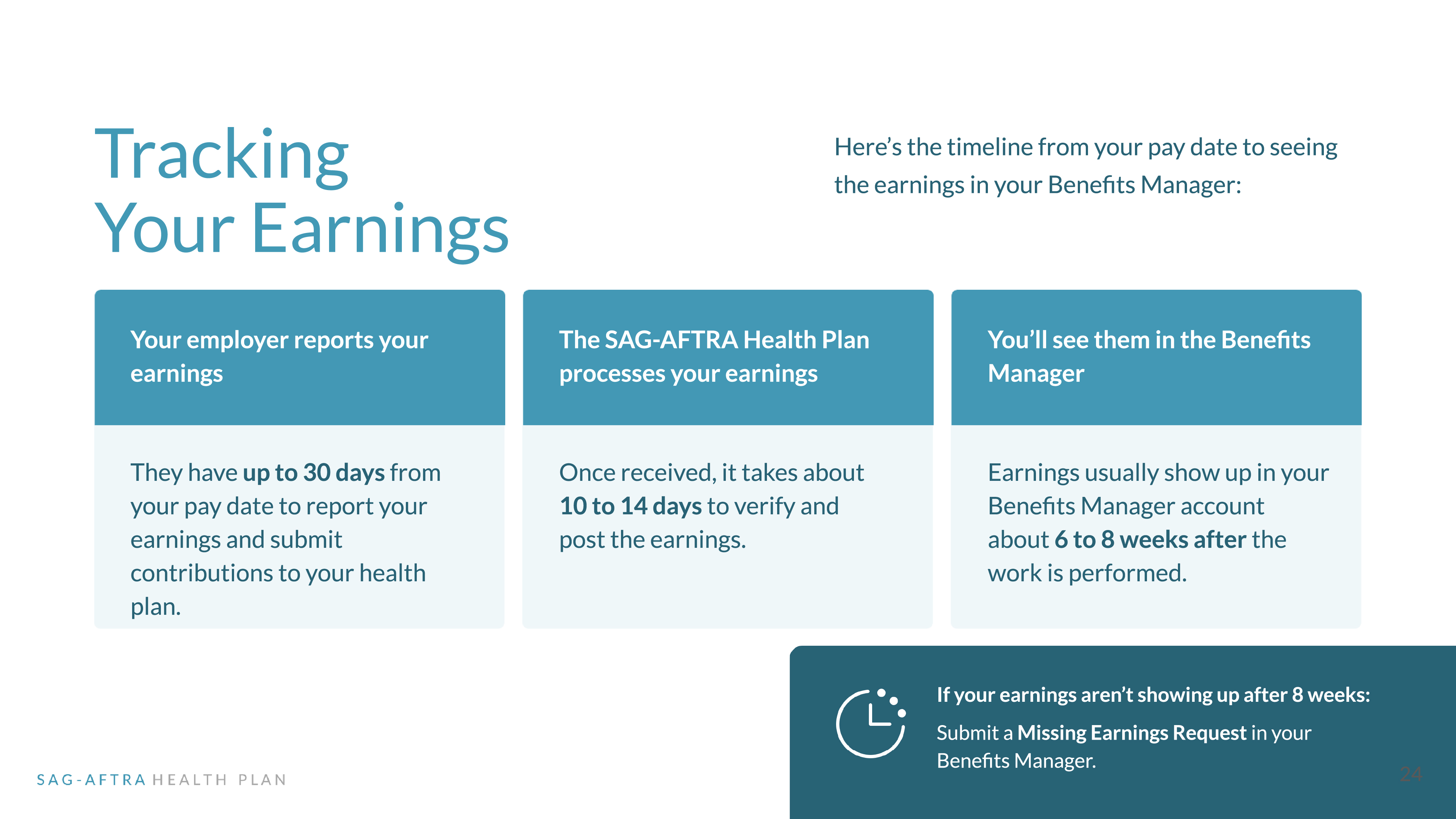

Under most Collective Bargaining Agreements (CBAs), employers are required to submit a report of applicable earnings and pay contributions to the Plans within 30 days of paying performers for their work. Thus, it is important to note that if you had a delay in pay, that delay will equally impact the timing of your earnings being reported to the Plans.

Our earnings process carries an intended administrative waiting period between Participants’ Earnings Period and Benefit Period. This is a crucial phase in the earnings process as it not only allows employers enough time to submit full and final reports of earnings without the need for later adjustments, but it also allows the Plans to receive, process, and verify earnings in time to assess your eligibility for the upcoming quarter. Proper verification of earnings is a lengthy process as it involves accurately identifying and crediting performer accounts, verification of employer signatory and verifying that the employer’s contributions were made in accordance to the CBA.

You may be wondering why some earnings show up much sooner than others on your Benefits Manager account, even though those earnings were for work performed much later in time. This is often dependent on whether the earnings were submitted in an electronic format or paper format. Earnings reported electronically (around 98% of reported earnings), will reflect on your statement much sooner as these are often automated by the system without the need for manual involvement. This process generally takes 1 to 2 weeks from the time the information is received to the time it reflects on your Benefits Manager portal.

In contrast, earnings reported in paper format (about 2% of reported earnings) will take more time to reflect on your earnings statement (generally 3 weeks), as these require manual processing (data entry, verification, coding, etc.) before they can be validated. Because paper reports lack electronic verification, they often come with missing/incorrect information, which requires Plan staff dedicate additional time and effort to obtaining the information they need from employers.

You should expect most of your earnings to be viewable on your Benefits Manager approximately 6-8 weeks after performing the work, assuming you were paid by the employer. Though we understand that the waiting period can be stressful and unsettling, we would like to assure our participants that we are actively seeking ways to improve our internal process and reduce its timeframe. We are also actively encouraging paper reporters to move to electronic submissions.

If it has been 8 weeks or more and you do not see your earnings reflected in your Benefits Manager portal, you can submit a missing earnings request. We ask that you first verify that it does not fall into one of the following categories:

Please see below for more information regarding common SAG-AFTRA agreement ceilings.

Ceilings by Production Type |

|

|---|---|

| Production Type | Current Ceilings (Gross Compensation) |

|

Theatrical |

$232,000 |

|

Television ½ Hour - filmed on/or before 6/30/2024 |

$15,000 |

|

Television 1/2 Hour - filmed on/or after 7/1/2024 |

$25,000 |

|

Television 1 Hour - filmed on/or before 6/30/2024 |

$24,500 |

|

Television 1 Hour - filmed on/or after 7/1/2024 |

$35,000 |

|

Television 1 ½ Hour |

$33,000 |

|

Television 2+ Hour |

$40,000 |

|

Network Code 1/2 Hour Serial |

$200,000 |

|

Network Code 1 Hour Serials |

$230,000 |

|

Network Code Sports |

$240,000 |

|

Network Code All Other Programs |

$250,000 |

|

Interactive |

$125,000 |

Theatrical ceilings are per performer per project.

Television ceilings include programs that are made for New Media platforms and are calculated per performer per episode (or per part if a Multi-part Closed End Picture*).

*Gross Compensation should not exceed $200,000 for the entire Multi-part Closed End Picture.

Network Code ceilings are per performer per employer per calendar year.

Interactive ceilings are per performer per program franchise per calendar year.

For any earnings that don’t fall into these categories, please submit a copy of your paystub(s) and/or contracts by email to [email protected] with a brief explanation of the issue and enough information to help us identify your account (e.g. name, SSN, HCID).

Please note: Bank statements and copies of checks are not considered valid proof of earnings as these do not include information about the work you performed.

Any unreported earnings that are determined to be valid will be credited to your account. The Plan will then begin its efforts to collect owed contributions from the employer.